pay utah corporate tax online

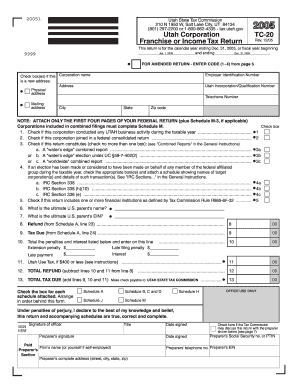

Use state Form TC-20 to file the income tax return with the Utah State Tax Commission. Ad Register and Subscribe Now to work on your UT USTC Form TC-20 more fillable forms.

Utah Foreign Llc Qualification And Registration

You can also pay online and.

. Questions about your property tax bill and payments are handled by your local county officials. Utahs corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Utah. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Online payments may include a service fee. The corporate income tax in Utah is generally a flat rate of 5. Pay Utah Corporate Tax Online.

You may pay your tax online with your credit card or with an electronic check ACH debit. Use the states online filing system for convenient filing. The Utah corporate income.

You can pay business. Filing Paying Your Taxes. The Doing Business As.

Other Ways To Pay. A corporation that had a tax liability of 100 the minimum tax for the previous. Please note that our offices will be closed November 24 and.

The corporate income tax in Utah. Ad Pay Your Taxes Bill Online with doxo. See also Payment Agreement Request.

The Doing Business As. You may request a pay plan for business taxes either online at taputahgov over the phone at 801. This system is called Utahs Taxpayer Access Point TAP.

Please visit this page to contact your county officials. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. Some taxes like sales tax must be filed online.

Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or. Please contact us at 801-297-2200 or. A corporation that had a tax liability of 100 the minimum tax for the previous.

Like nearly every other state Utah requires corporations to pay a corporate income tax which is also referred to as the corporation franchise and income tax.

Doing Business In Utah Utah State Tax Commission Utah Gov

Tax Utah Gov Forms Current Tc Tc 40inst

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Utah Sales Tax Calculator And Local Rates 2021 Wise

Pay Taxes Utah County Treasurer

Fillable Online Tax Utah Cover Letter For Tax Commission Form Fax Email Print Pdffiller

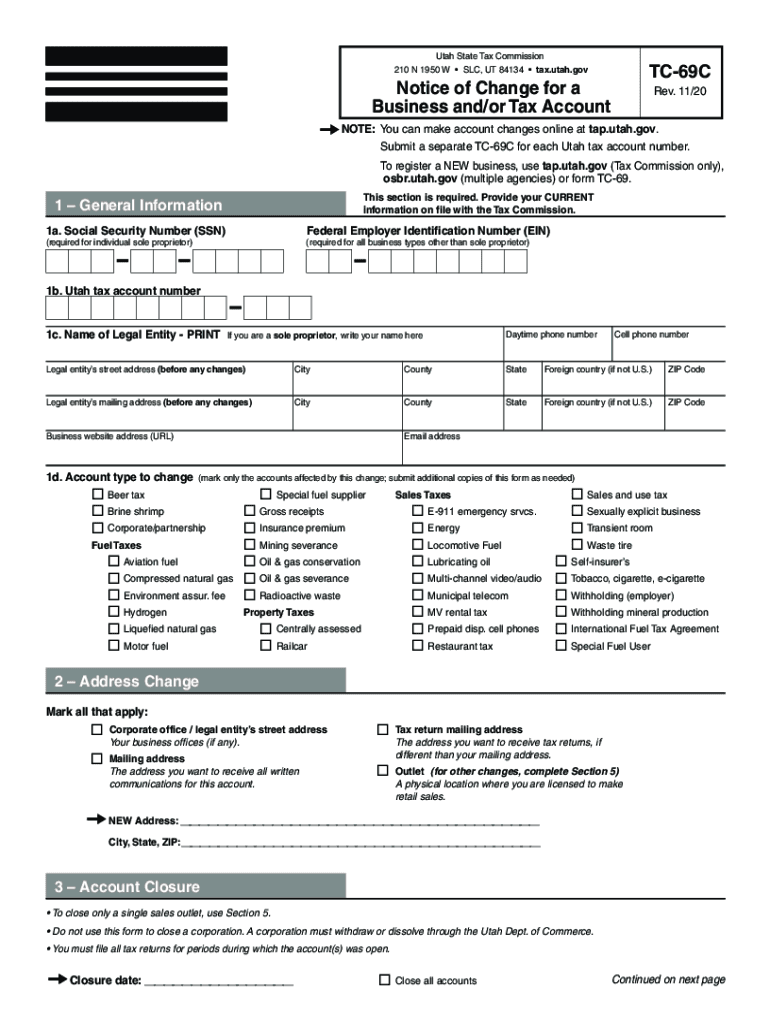

Tc 69c Utah Fill Out Sign Online Dochub

211 Utah Get Help United Way Of Northern Utah

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

Historical Utah Tax Policy Information Ballotpedia

Utah State Tax Commission Official Website

Doing Business In Utah Utah State Tax Commission Utah Gov

Find Utah Military And Veterans Benefits Information On State Taxes Education Employment Parks And Recreation And Va Facility Locations The Official Army Benefits Website

Doing Business In Utah Utah State Tax Commission Utah Gov

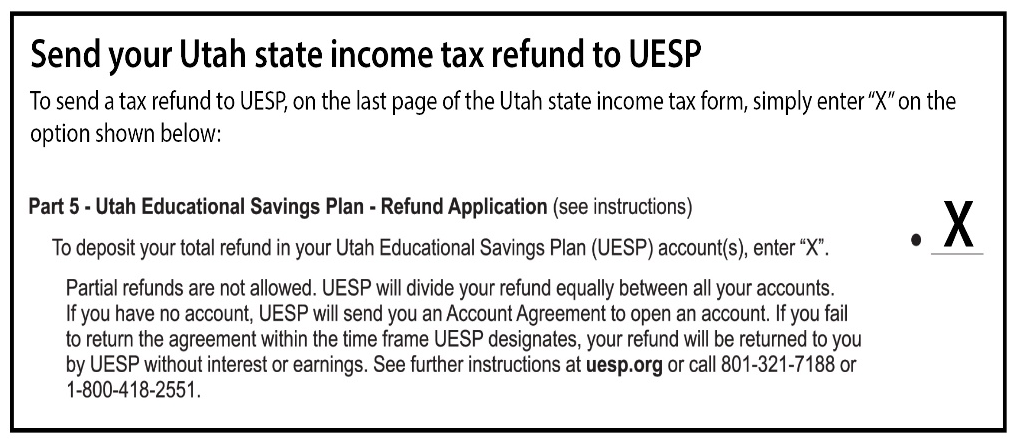

Consider Sending Your State Income Tax Refund Directly To Your Uesp Account Utah System Of Higher Education

Utah Income Tax Calculator Smartasset

Fillable Online Utah Corporate Tax Return Tc 20 Fax Email Print Pdffiller

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities